Reports are out that Bitcoin is now being dropped for Monero by some of its earliest and most avid users: underworld criminals.

There is no doubt that Bitcoin is the king when it comes to cryptocurrencies. Over recent years, this virtual currency has steadily made its way to the top, earning the interest of millions of people around the world. However, lawbreakers are not particularly happy with its gained popularity and are reportedly dropping Bitcoin for another cryptocurrency, Monero.

With the advent of new tools developed by software firms to track Bitcoin transactions plus the global call for the regulation of the said digital currency, Dark Web and underworld criminals are left with no choice but to shift to other privacy coins.

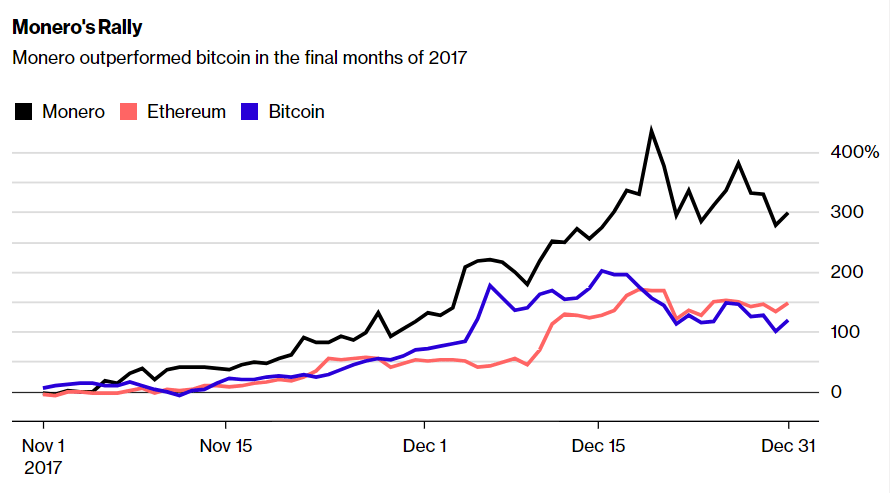

According to a report from Bloomberg, privacy coins such as Monero, which are designed to avoid tracking, have climbed faster over the course of two months as a result of law enforcement crackdowns.

#Cybercriminals to use #Monero as primary currency over #BitcoinClick To TweetAnalytic firms such as Chainanalysis also got better at flagging Bitcoin transactions associated with money laundering and other crimes, thus blocking criminals from converting their gains to cold cash.

Monero as the Criminal Underworld’s new Currency

Three months ago, Europol, the European Union’s law-enforcement agency, alarmed governments in a report that “other cryptocurrencies such as monero, ethereum, and Zcash are gaining popularity within the digital underground.”

It was reported that online hackers who use ransomware to lock computers and extort money from victims in exchange for their files have already started demanding payments in those three virtual currencies.

Also, a report from the cybersecurity firm WordFence last December 18th and 19th said that an unknown group of hackers launched a massive brute force attack campaign targeting around 190,000 WordPress sites per hour. Further investigation from the firm revealed that the hackers’ primary purpose was to install Monero cryptocurrency miners in sites that they successfully penetrated.

In a phone interview with Bloomberg, the founder of the Dubai-based security firm Comae Technologies, Matt Suiche, said that Monero is now “one of the favorites, if not the favorite.”

Data from Coinmarketcap.com showed how Monero outperformed Bitcoin in the last two months of 2017.

However, aside from Bitcoin’s current popularity, criminals are also choosing privacy-focused currencies because the Blockchain technology behind Bitcoin could allegedly be used against them.

If you haven’t heard of it yet, Blockchain is the so-called digital ledger that meticulously records which addresses send and receive transactions in the Bitcoin network, including the exact amount and time involved in each transaction. Not really the sort of data that criminals would want to keep or leave behind.

In cases like this, Monero comes in handy for lawbreakers since it’s virtually untraceable. It even appears to be made solely for illegal activity as it provides fake identities, coordinates, and payments for any kind of transaction.

However, if you think Monero is private enough, its main competitor, Zcash, is said to be even better. While it has not gained any significant underground following yet, Zcash offers privacy protection by encrypting the real address of its user. This makes it impossible to trace the senders by searching for correlations in addresses used in multiple transactions to find the real one–an apparent flaw of Monero.

Nevertheless, virtual currency enthusiasts like John McAfee believe this only means that privacy coins would become better investments in the near future.

IMO the entire discussion of cryptocurrencies that have no inherent value, and are not recognized or guaranteed by any banks, is pointless for most of us. They are the play toys of the rich and mainly the currencies of the criminal underworld, including their illicit transactions with ordinary people – prostitution, illegal gambling, tax evasion, etc. They are also a sign of a deeper problem: when the “real” currencies of the world are challenged by these worthless piles of bits, it means that many people really don’t trust the value of the “real” ones. This is a sign of generalized collapse.