Bitcoin Cash price surges to its all-time high on Sunday, overthrowing Ethereum as the second largest cryptocurrency.

Bitcoin Cash (BCH), the product of a previous fork from Bitcoin (BTC) in August, recently skyrocketed in value.

According to experts, the sudden surge in the Bitcoin Cash price was partly due to issues faced by the legacy Bitcoin. The latest involves the cancellation of the SegWit2x hard fork scheduled to take place this November.

The last few days saw the value of Bitcoin Cash jump to ~$600 USD from a $300 USD decline last month. As of Friday, its lowest traded value was around $650 USD. However, Sunday was a historic moment for the struggling cryptocurrency as the Bitcoin Cash price suddenly spiked to around $2,500 USD per coin.

#BitcoinCash reached all-time high over the weekend, beating #EthereumClick To TweetThe surge in BCH’s value allegedly made it the second largest and most valuable cryptocurrency next to Bitcoin, overthrowing Ethereum (ETH) from the runner-up spot. As of press time, one ether is valued at around $314 USD.

Bitcoin Cash’s value is now down to around $1,200 per coin.

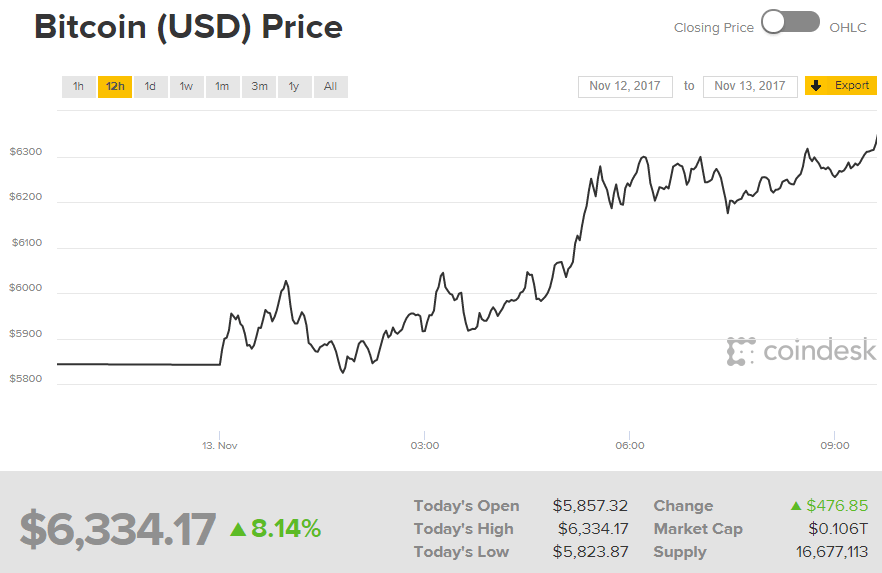

Right now, legacy Bitcoin comes in at around $6,300 USD per coin.

Revenge of the Fallen: How SegWit2x Supporters Boosted Bitcoin Cash Price

Cryptocurrency experts speculated that the sudden movement in the virtual currency market was greatly influenced by the disgruntled developers of the SegWit2x who failed to accomplish their hard fork plans. Reports claimed that the said group moved their money over to Bitcoin Cash–whose vision seemingly coincides with theirs.

The SegWit2x supporters, known as the 2xers, wanted to increase the blocksize of Bitcoin to 2MB as a solution to the limited processing capability of the network. Apparently, the current 1MB per block limit of Bitcoin only enables it to process no more than around seven transactions per second. This blocksize issue causes transaction fees to rise, making it difficult to use Bitcoin for small transactions.

However, the 1exers, or the people who opposed the SegWit2x hard fork, believed that allowing transactions to flood the network would defeat the purpose of Bitcoin’s decentralization. According to them, SegWit2x would make it difficult for ordinary miners to participate in the network’s clearing process.

The 1exers supported the Segregated Witness soft fork back in August which helped squeeze more transactions in each block. SegWit moves cryptographic signatures outside the 1MB block limit and temporarily brought some ease to the transaction congestion that plagued the blockchain for months.

In the weeks leading up to the SegWit2x hard fork, markets appeared to indicate that BTH would retain control of around 85% of the cryptocurrency’s value while the 15% would go to the SegWit2x proponents. On Wednesday, the team eventually canceled the hard fork and Bitcoin on the same day reached a new all-time high.

A few days after SegWit2x opposition celebrated their victory, the story suddenly changed over the weekend as Bitcoin slumped (a little) while the Bitcoin Cash price surged.

Kyle Samani, a managing partner of MultiCoin Capital, wrote in a message to Forbes:

“There were lots of Bitcoin Cash whales who were in early on Bitcoin who were waiting to see what would happen with 2x. Now they’re making their move. They’re dumping BTC for BCH….I know many Bitcoin OGs who have dumped $10m+ of BTC for BCH … Turns out there were a lot more BCH ideologues than we all thought.”

Samani also confirmed that Multicoin sold BTC for BCH in the last 48 hours.

“Ideologically, I gave up on Bitcoin long ago but I’m a fiduciary now so I have to make money on the swings,” Samani said.

Jihan Wu, CEO of Bitcoin mining equipment Bitmain, wrote on WeChat:

“Right now we have both BCH and BTC, but we believe BCH has more potential.”

On the other hand, Samson Mow, chief strategy officer at Blockstream and a Bitcoin evangelist, was not impressed with the surge in the Bitcoin Cash price. He told Business Insider:

“[Bitcoin cash] is just being pumped as many other altcoins have been in the past, and inevitably the pumpers will cash out. The pump is already losing steam and can’t be sustained because there’s no real market for [bitcoin cash].”

Comments (0)

Most Recent