Most recent reports of the Equifax hacking incident confirmed that millions of customers’ personal information had been stolen and almost half of the United States’ population could be affected.

Hackers are on the loose again, and their most recent campaign resulted to one of the worst cybersecurity breaches to date in the United States–the Equifax hacking incident.

According to CNN, the cyber criminals were able to obtain sensitive information such as names, social security numbers, birth dates, addresses, and the numbers of some driver’s licenses.

#Equifax was hacked! Customer personal data stolen!Click To TweetAside from that, Equifax also confirmed that over 200,000 of their U.S. customers now have their credit card numbers compromised. If that is not bad enough for the consumer credit reporting agency, ‘personal identifying information’ related to around 182,000 customers involved in credit report disputes were also exposed.

Investigations suggest that the Equifax hacking incident happened between May and July. The company discovered the data breach on the 29th of July. Right now, experts deemed the Equifax data breach as one of the worst to ever happen in terms of private information exposure.

Referring to the issue, Equifax chairman, and CEO Richard F. Smith was quoted as saying:

“This is clearly a disappointing event for our company, and one that strikes at the heart of who we are and what we do.”

The Equifax Hacking and how it will Affect the Americans

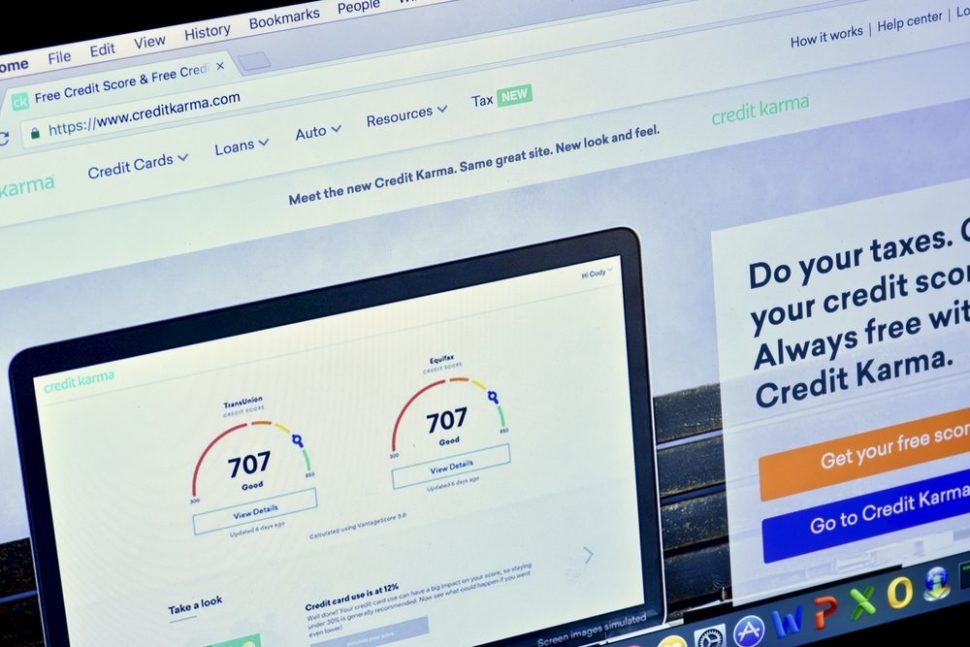

Equifax is a consumer credit reporting agency and is considered one of the three largest in the U.S. together with TransUnion and Experian. As a credit reporting agency, the company’s primary role is to track and rate the financial history of U.S. consumers.

Companies like Equifax have a huge supply of financial data about loans, credit disputes, loan payments, and credit card. Aside from that, their database also includes other consumer information ranging from child support, missed rents or utility payments, and credit limits to a person’s addresses and employer history. All of which affects the credit score of an American citizen.

Because of this vast reserve of information, consumer credit reporting agencies are favorite targets of cyber criminals. The Equifax hacking incident is not as big as the Yahoo hacking incident in 2016, yet, in terms of severity, what happened to the company is said to be one of the worst.

This is due to the fact that hackers were able to steal a significant amount of information enough to unlock bank accounts, medical histories, and employee accounts. Avivah Litan, a fraud analyst at Gartner, said:

“On a scale of 1 to 10 in terms of risk to consumers, this is a 10.”

In total, around 143 million Americans are currently affected by the data breach. The figure is almost half of the population of the U.S. that seats at 324 million according to the Census Bureau.

According to Equifax, the company learned of the hacking on July 29th, citing that “criminals exploited a U.S. website application vulnerability to gain access to certain files.”

Unlike common security breaches, not all the consumers affected are aware that they’re even in the list of the company. This is because Equifax gets customer information from banks, credit card companies, lenders, and retailers who report the credit activity of individuals to credit reporting agencies.

In a statement to CNBC, Christopher O’Rourke, founder, and CEO of cybersecurity firm Soteria said:

“This is a security risk for any and every website that anyone uses. Most often, security questions to access those websites use that data, like a previous address, so this becomes an open-source intelligence nightmare, worse in many ways than the Office of Personnel Management government breach. It’s nasty. If I can get my hands on that information I can call a bank. They’re going to ask me for your Social, address, the information that was leaked here, to get access.”

With this large-scale data breach, experts advise everyone to check their bank and credit card statements regularly.

“This is reason Number 10,000 to check your online bank statements and credit card statements on a regular basis, ideally weekly,” said Matt Schulz, senior industry analyst at CreditCards.com. “Bad guys can be very patient, so it’s important to keep an eye out long after this story fades from the headlines.”

Right now, Equifax said that they are in the process of alerting customers whose information was compromised. The company was also said to be working closely with the state and federal authorities. The identity of the group behind the Equifax hacking is still unknown.

Comments (0)

Most Recent